What kind of auto insurance do I need?

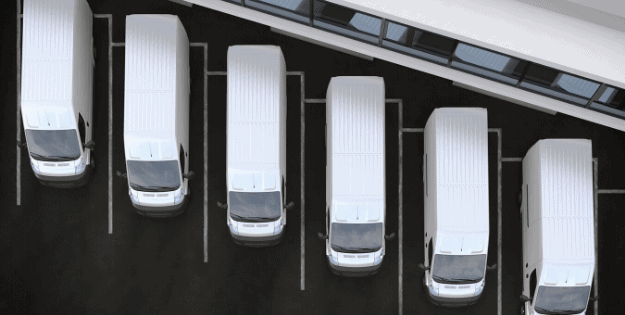

Anytime you are on the road, you are at risk of an accident. Even if you are a completely safe driver, you cannot control everyone else on the road. Commercial Auto Insurance helps make sure that any commercial vehicles owned by your business are covered while on the road. Anything from work trucks to delivery vans, and everything in between, commercial vehicles get your business where it needs to go, and commercial auto insurance makes sure that an accident doesn’t keep you from getting your work done.

Commercial Auto Insurance Northern Kentucky & Cincinnati

Commercial auto insurance can cover a combination of vehicle types (trucks, cars) and drivers, as well as some types of motorized equipment. It provides for bodily injury liability and property damage while operating a company automobile, and medical payments or Personal Injury Protection (PIP) for the driver and passengers of the policyholder's car.

Hired/Non-owned Auto Liability

Are you renting cars or are your employees using their own vehicles? This particular coverage provides business insurance coverage for certain liabilities arising from the use of a rented or leased vehicle (hired), or a non-owned vehicle (employee using their own vehicle on company business). Oftentimes this coverage can be added inexpensively to a business auto policy, or in some cases, a general liability policy.

Use of Personal Vehicles

Insurance policies for privately owned vehicles may not cover damage to your privately owned car or truck when it is used for business, even when it's a business such as selling cosmetics, jewelry, or pizza delivery.

Every business is unique – talk to Intelli Choice Insurance today to find out how to get the best business auto insurance, service, price and value.